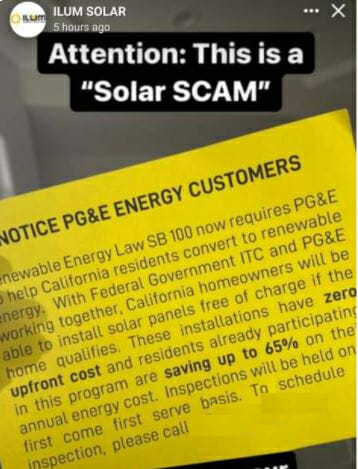

Some ads on Facebook and other social media platforms tout “free solar” or “free electricity,” claiming the local utility provider or the state government will pay for the cost of a solar system.

Other ads feature buzzwords like “NO-COST,” or “ZERO UPFRONT COST” trying to entice people to click their hard-to-believe offers.

These ads are deceptive. There are no free solar power systems.

If you see an ad or a solar company touting “solar with no money down,” they’re talking about solar financing.

“NO MONEY DOWN!” sounds great, but it never means free. It simply means that you don’t have to make a lump-sum down payment in order to secure a loan—just like the no-down-payment loans sometimes promoted by car dealerships. The loan still has to be paid off.

The same goes for solar companies offering no money down system installations. Just like car dealerships, not every solar company offers this incentive. But the ones that do expect you to finance the system and pay it off over the course of a few years.

This isn’t the worst news for prospective solar buyers. There are several solar-specific financing options available to help you afford the upfront cost of going solar.

If you find a “no money up front” offer, it likely falls under one of the following financing options:

Lease: This is just like a car loan. You will agree to a loan and term length, paying it off over time. With this agreement, the solar company which installs the system will also own the system. You will not be eligible for the Solar Investment Tax Credit, but you’ll still get all of the benefits that come with a solar power system.

PPA: Under a purchase power agreement (PPA), the homeowner or business owner does not own the solar system—the solar company which installs the systems owns it. The solar company will charge you for the electricity produced by the system, just like a utility company charges you a monthly rate for electricity and gas. Again, you won’t qualify for the federal tax credit, because you do not own the system.

PACE: PACE financing is funded by either public or private funds, depending on the region. This loan is secured against your home. You pay off the loan through property taxes assessed annually over a period of 20 years.

You can read more in our blog post about solar power financing to help figure out if financing solar is the right choice for you.

What about local, state, or federal solar incentive programs—do they get the price of a solar system anywhere near $0?

The federal Solar Investment Tax Credit (ITC) is the only federal solar incentive program in the United States. As of 2020, the ITC provides a tax credit worth 26% of the total cost of your solar system, including the cost of installation and related labor.

That sounds great—and it is!—but the ITC incentive will come to an end. On January 1st, 2021, the tax credit will decrease to 21%. In 2022 and beyond, the tax credit will no longer exist.

Solar companies around the country promote the ITC as a way for potential customers to save money. You should be quick in your decision to purchase or not, since you stand to save significant money if you buy a solar system in 2021, rather than waiting until after the ITC ends.

Local and state solar incentives don’t really exist.

That state of California offers no solar incentive programs. However, there is a state assistance program which helps low-income households acquire a solar system—Single-family Affordable Solar Homes Program, or SASH. They provide low-to-no-cost solar systems for qualifying families. They even task volunteers and trainees with installing the system in order to get them some real-world experience. You can learn more about SASH and how to apply on their website.

There are no incentives for solar buyers on the county or city level either.

The only place you might find money-saving opportunities is with your utility provider. For example, SMUD currently offers a $300 incentive for homeowners that purchase solar. And in Riverside County, Rancho Mirage Energy Authority (RMEA) will provide a $500 rebate to cover the cost of acquiring permits.

You can also take advantage of net energy metering, a program which most utility providers offer. This incentive program allows you to “sell” the energy produced by your solar system to the utility grid. You’ll receive a credit on your bill based on how much energy your system generated for the grid.

The reality is that solar incentive programs are few and far in between. There is no such thing as a free solar system, so don’t expect to find such an unbelievable deal. The ITC is the best way to save money when buying a solar system. You might find incentives and rebates with your local utility provider, so be sure to check with them to see if you can save even more money.

Once 2022 rolls around, the ITC will no longer exist. If you’re in the market for solar, act now! Contact Ilum Solar today and we will be happy to discuss installing a solar system on your home or business.